We’ve all discovered our selves able where we are in need of a bit of more income. Credit cards might be a solution for small amounts of currency, but big costs need more. One way to defense even more costs that you experienced – unanticipated otherwise prepared – is by using a consumer loan.

But how manage personal loans works? How much cash is the attention into a personal bank loan? What kind of cash would you borrow? You don’t need to worry. We have covered the basic principles right here.

Regular Apr Private Finance

Signature loans resemble other sorts of loans – auto loans, mortgages, an such like. You borrow funds and pay it off during a period of time with attract. The attention and you may charges associated with mortgage try demonstrated by the brand new annual percentage rate (the latest Apr).

The fresh Apr from the a personal loan may vary based on a good partners facts, the initial at which will be your credit score. As an instance from just what rate you could be prepared to pick, According to Company Insider, at the time of 2020, we offer differing prices according to your credit rating:

- Higher level credit (720+): might be eligible for a minimal cost have a tendency to performing around 10%-12%

- Good credit (690-719): predict a performance birth as much as twelve-%15%

- Reasonable borrowing from the bank (630-689): predict a speeds in the 20% diversity

- Need performs (629 and lower than): you may expect to invest over 29%

As you can see contained in this example, which have advanced level borrowing from the bank, you could potentially spend a little while more than ten% getting a consumer loan. If your borrowing is found on the reduced stop of your own spectrum, new ong lenders or any other situations this will give you good general idea out-of what to expect.

How much Can you Borrow?

Extent you could potentially borrow with a personal loan depends on the lending company. Some lenders will get lay a limit from $fifteen,100 into unsecured signature loans, while others will get give up to $a hundred,one hundred thousand.

Shielded compared to. Unsecured

Some personal loans is actually shielded, while some is unsecured. A secured financing means you will find some equity sworn so you’re able to the financial institution in the case that you standard. Secured finance is going to be more straightforward to qualify for, even with bad credit, since the financial has some insurance rates whenever you are incapable of afford the cash return.

Have a tendency to, secured personal loans have less Annual percentage rate, but there is a whole lot more risk on it. Skipped payments into the secured personal loans commonly impact your credit score more seriously. At exactly the same time, for those who default to your loan, not only will you destroy your credit and clean out your own collateral.

How Personal loans Feeling Your financial Fitness

Unsecured loans are a good otherwise damaging to debt health. It really relies on the way you make use of them as well as how you do her or him.

For example, starting another credit line will get change your credit history by adding towards the brand of borrowing you have. It also helps your make your borrowing if you make regular on-time repayments.

You to quite popular reason for taking a personal loan are debt combination. For people who pay-off several credit cards in financial trouble owing to a good unsecured loan, this can help you get a handle on your debt and you will alter your financial fitness over time. This is also true if for example the unsecured loan has a lower rate of interest as compared to playing cards you pay out of.

On the other hand, if you don’t https://www.elitecashadvance.com/installment-loans-va/hamilton/ manage your personal bank loan responsibly, could cause greater indebted. You’ll also have to pay charges to take out the borrowed funds to begin with, so be sure to are able to afford these costs.

Where you can Get Signature loans

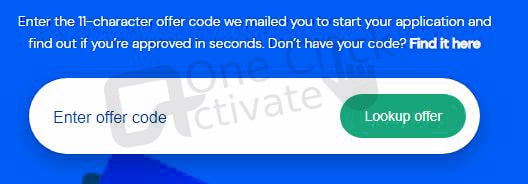

On line lenders ensure it is easy to seek and you may compare money. Banking companies supply personal loans, normally set aside getting consumers that have pretty good credit, when you are borrowing unions are a good selection for individuals exactly who you’ll n’t have a knowledgeable borrowing from the bank. Borrowing from the bank unions supply an array of financing amounts, and really small unsecured loans which could not available someplace else.

Regardless of where you’d like to obtain from, one thing can help you was shop around to search for the greatest Apr out there. Playing with online hand calculators for personal financing allow you to compare loans with other repayment symptoms, Apr, and you can terms.

Installment

After you have chosen financing and taken it out, you’ll be able to signal some files, plus the money might possibly be placed on your membership. From that point, you are able to build monthly premiums into dominating and you can Apr into the name you’ve accessible to. Just like the loan try paid back, your account try closed.

Signature loans vs. Playing cards

Unsecured loans and credit cards both provides the advantages and disadvantages. Always, credit cards are a great complement reduced, repeated purchases, while you are unsecured loans function better suited for huge costs and you may personal debt combination. Nonetheless it is somewhat more complex than just that. Here are a few our very own post on the signature loans against. handmade cards so you’re able to most useful comprehend the nuances.